The cement industry has the opportunity to grow in 2023 despite the oversupply sentiment. Consolidation of a number of cement companies and increasing demand for cement for infrastructure development are the drivers for the industry to grow. In addition, the energy transition is also contributing positive sentiment to the growth.

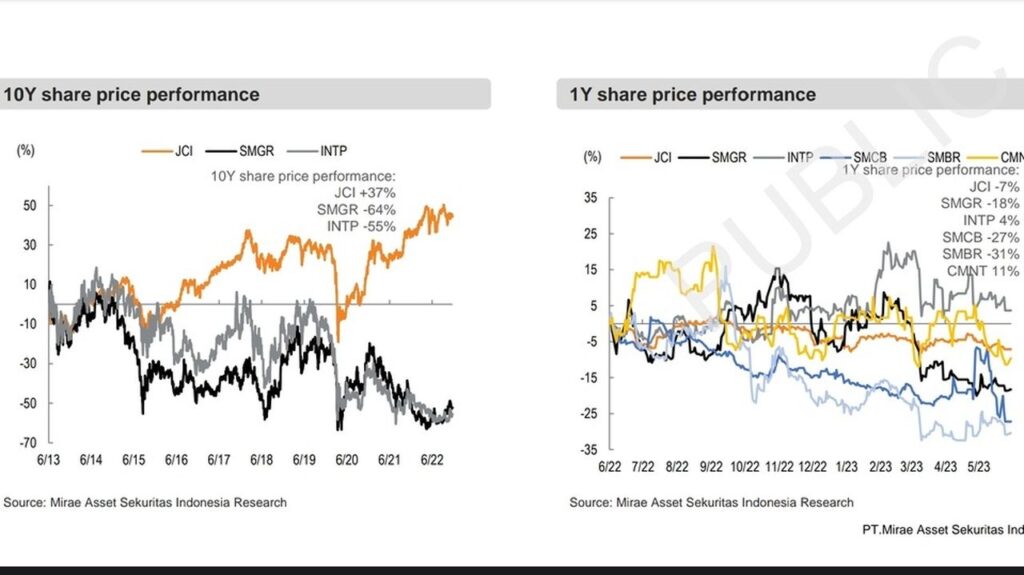

Two domestic cement giants, PT Semen Indonesia (Persero) Tbk and PT Indocement Tunggal Prakarsa Tbk, showed positive performance since the beginning of 2023. In the first quarter of 2023, Semen Indonesia posted a net profit of Rp 562 billion, an 11 per cent growth compared to the same period in 2022. Meanwhile, Indocement posted a net profit of Rp 371.4 billion or grew 103 per cent compared to the same period the previous year.

Mirae Asset Sekuritas Research Analyst Emma Almira Fauni said, cement sales this year can grow although not too significantly. The growth is projected to be between 0 per cent and 5 per cent compared to last year which was minus 3 per cent.

‘Cement companies have prospects for growth in 2023.

However, in general, there will still be oversupply.This is because there are many new players after the property sector started booming in 2010 to 2014, which has increased competition and new cement factories have sprung up,’ he said at the Media Day: June 2023 entitled ‘Cement Industry Outlook will Build Positive Pathway for JCI’ held by Mirae Asset Sekuritas, in Jakarta, Thursday (8/6/2023).

June 2023 entitled Cement Industry Outlook will Build Positive Pathway for JCI held by Mirae Asset Sekuritas, in Jakarta, Thursday (8/6/2023).

The oversupply of cement can be seen from the gap between the amount of production and domestic cement demand.

Based on data from the Indonesian Cement Association, cement production in 2022 has reached 116.8 tonnes, while domestic demand is only 63 tonnes. Thus, the utilisation rate of domestic cement production reaches 54 per cent.

According to Emma, the utility rate will be more optimal or above 70 per cent so that the company becomes healthier. This utility rate is useful to see the effectiveness of production.

‘Structurally, this condition will tend to improve along with the government’s efforts in conducting a moratorium on cement factories. There is hope that cement production capacity growth will be lower than in previous years,’ he continued.

In addition to the moratorium, the consolidation efforts of cement companies are considered to be enough to dampen the competitive climate in the cement industry. In 2022, Semen Indonesia made an acquisition by accepting the transfer of 7.5 billion series B shares or equivalent to 75 per cent of the ownership of PT Semen Baturaja Tbk.

On the other hand, in the same year, Indocement also entered into a leasing contract to lease assets (operating lease) from PT Semen Bosowa Maros for 3 years to 5 years.

When accumulated, the two acquisitions by the two cement giants have a production capacity of 69 per cent or an increase of 6 per cent compared to the previous year.

Growth drivers in the cement industry also come from demand in the infrastructure and construction sectors. In recent years, demand for bulk cement has increased by 27 per cent by 2022. Meanwhile, demand for bagged cement, Emma said, stagnated between 70 and 80 per cent, even falling to 73 per cent by 2022.

Mirae Asset Senior Economist Rully Arya Wisnubroto explained that this year the government has increased the infrastructure development budget to Rp 392 trillion from Rp 365.8 trillion in 2022. The budget will be focused on basic services, such as the construction of houses, schools, drinking water supply, and road construction.

‘As of April 2023, the realisation of infrastructure spending has only reached Rp 59.7 trillion or equivalent to 15.2 per cent of the total 2023 budget. The realisation of infrastructure spending needs to be accelerated to support increased economic growth, both in the short and long term. With the acceleration of infrastructure development, the level of cement demand will also increase,’ said Rully.

The ongoing global uncertainty, Rully added, will impact commodity prices and monetary tightening so that economic growth in the second half of 2023 has the potential to slow down. Therefore, the acceleration of infrastructure development is expected to support the economy from a possible slowdown.

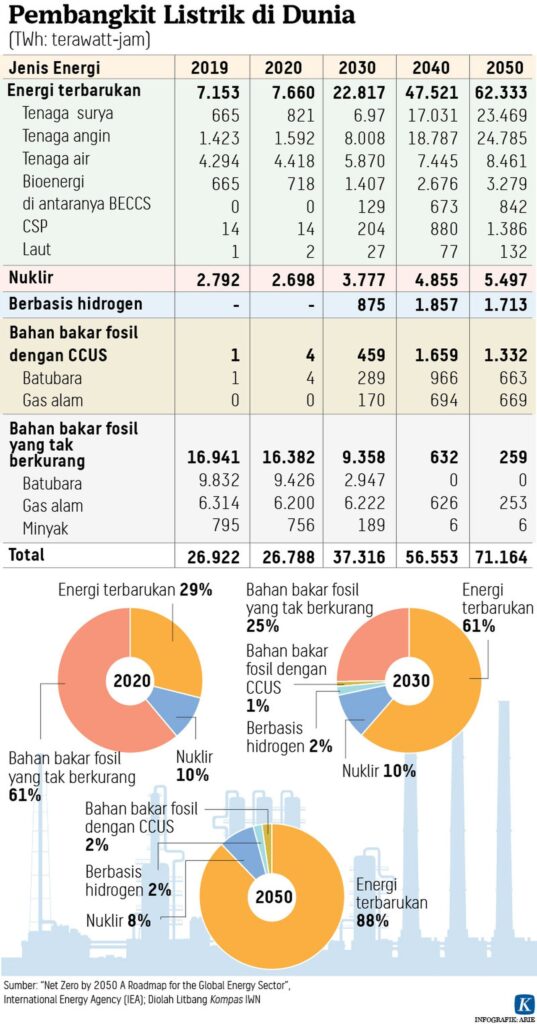

Energy transition sentiment

The commitment from countries to tackle global climate change by achieving zero carbon emission targets has led a number of cement companies to make breakthroughs. One of the breakthroughs is to make an energy transition.

‘This effort can be a chance for cement companies to be seen by investors. Moreover, the contribution of alternative energy users is increasing from year to year. In addition, this effort also reduces dependence on coal,’ said Emma.

Indocement, through its official statement at the public expose, said that the level of alternative fuel consumption increased from 12.2 per cent in 2021 to 18.1 per cent in 2022. Semen Indonesia, in its official statement, said it had reduced its carbon emission intensity to 590 kilograms of CO2 per tonne of cement, down 16.67 per cent from the 2010 baseline of 708 kg CO2 per tonne of cement.

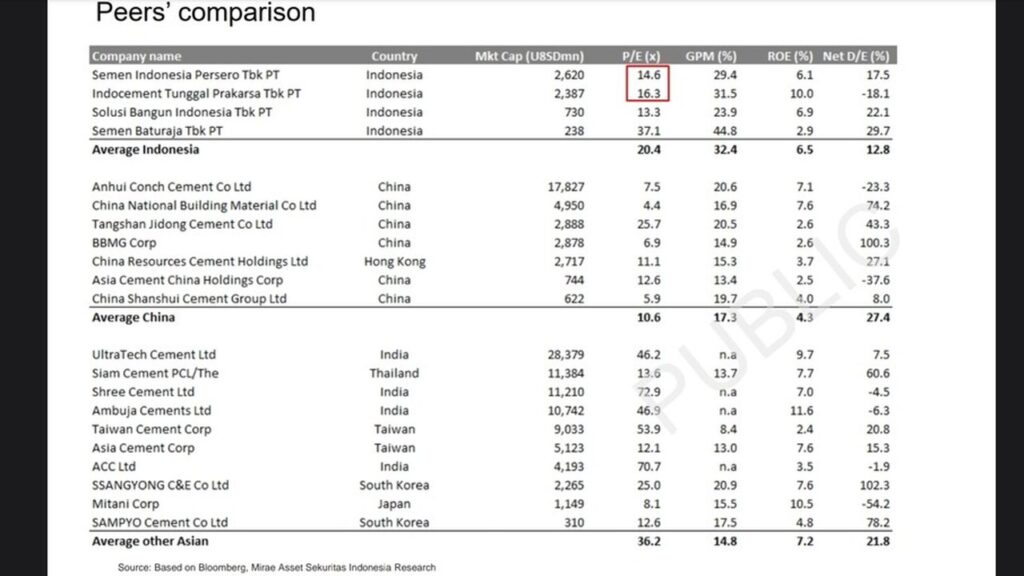

Emma added that shares of domestic cement companies tend to be favoured by foreign investors because they have a higher level of profitability than cement companies in other countries. The gross profit margin (GPM) of the domestic cement industry can reach around 30 per cent, while the GPM of the global cement industry, especially China and other Asian countries, is only around 15 per cent.

In addition, the share price valuation of domestic cement producers is also considered cheaper than producers in other Asian countries. Domestic cement producers have a price earning ratio (PER) of 20 times, while other Asian countries have a PER of 35 times.

Quoted from : Kompas